Documentary Credit

DOCUMENTARY CREDIT

The right solution for international businesses

What can be included in a Documentary Credit?

Higher security and guaranteed receipt

Extended payment terms to suppliers

Assessment and mitigation of the main Risks inherent to international trade

Allows the anticipation of funds through parallel banking operations, such as discount or allowances on the letter of credit

Transactions based on the rules and uniform usage of the International Chamber of Commerce, as well as, by the laws of Banco Nacional de Angola

Features

Analyze what product can best serve your needs, whether it is receipt through Export or payment through Import;

Documentary credit is a credit made available to guarantee to Companies the payment of transactions regardless of the Customers' ability to settle;

- It is Credit because it is an irrevocable commitment by an issuing Bank to honor a payment obligation accordingly;

- It is Documentary because the business transaction and the guarantee of payment is confirmed by the existence of the documents;

- This commitment involves the Import and Export activity and provides trust between both commercial parties;

Import Documentary Credit - an agreement for opening credit, established between ATLANTICO and the Importer Client, in which a credit is granted by signature with conditions specified in the agreement;

Export Documentary Credit - a safe way to irrevocably guarantee the receipt of the amount referring to the export, against delivery of the documents and fulfilled the terms and conditions of the credit. Allows the negotiation of anticipated receipt of the export amount after delivery of the documents to the Bank.

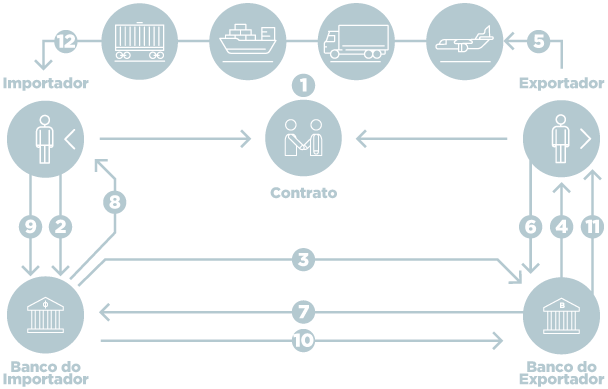

How it works

The Bank of your foreign Supplier forwards to ATLANTICO the documents necessary for pickup the goods imported by your Company. The documents will be delivered to you against payment, acceptance, or partial payment and acceptance of the remainder, according to the conditions determined by the Exporter

Caption

1. Beneficiary - Requests from the Issuing Party a Bank Guarantee according to the service/conditions that have been agreed upon;

2. The Issuing Party requests its Bank to contact the Beneficiary's Bank of the Residence/Geography, so that it can issue the Guarantee in favor of the Beneficiary;

3. The Issuing Party requests the Guarantor Bank, (Beneficiary's Bank) to issue the Guarantee in favor of the Beneficiary, counter-guaranteed by it;

4. The Beneficiary Bank reviews the details of the transaction, and accordingly issues the guarantee and forwards it to the Issuing Bank;

5. The Issuing Bank forwards the guarantee to the Issuing Party;

6. The Issuing Party validates the documents and forwards them to the Beneficiary;

Note: There are cases where the documents are delivered by the Beneficiary Bank directly to the Issuing Party.

Support

If you wish to obtain information according to your needs (opening of letter of credit or verify the letter of credit status) contact us: (+244) 226 460 460 or (+244) 923 168 168

Have doubts? We'll answer them!

Buy a House

Buy a House

Open a current account

Open a current account

Protect my family

Protect my family

Invest

Invest

Ask for a Card

Ask for a Card

Buy a Car

Buy a Car

Save for the future

Save for the future

Login

Login Open an Account

Open an Account