Bank Guarantees

BANK GUARANTEES

Specialized financial instrument useful for cross-border business.

Advantages:

Major security and guaranteed receipt;

Extended payment terms to suppliers;

Assessment and mitigation of the main Risks inherent to international trade;

Permits the anticipation of funds through parallel banking operations, such as, discount or allowances on the letter of credit;

Acted on the basis of the rules and uniform usage of the International Chamber of Commerce, as well as, by the laws of the National Bank of Angola.

Features

It is a financial solution, in which the Bank undertakes to secure the obligations that cannot be fulfilled by its Customer.

Generally speaking, Guarantees are required for admission to tenders, carrying out construction work, lease contracts, etc.

They have different types:

-

First Demand, including Stand By Letter of Credit;

-

Surety Default Guarantees;

And different natures:

-

Directives;

-

Indirect;

-

Tendered;

-

of Deposit;

-

of Payment in Advance;

-

Payment Bond;

-

Maintenance Bond;

-

Retention Money Guarantee;

-

Payment Bond;

-

Maintenance Bond;

-

of Global Customs Clearance Bond;

-

for Collateralizing Financing;

So, Bank Guarantee can assume the following characteristics:

Can be used in lieu of Credit, collecting payments and interest;

Can be used for tax compliance;

Can be used as a hedge for goods and services operations associated with stimulating the real economy.

How it works

The Bank of your foreign Supplier sends to ATLANTICO the documents necessary for the withdrawal of the goods imported by your Company. The documents will be delivered to you against payment, acceptance, or partial payment and acceptance of the remainder, according to the conditions determined by the Exporter.

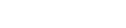

Legend

1. Beneficiary - Requests from the Ordering Party a Bank Guarantee in view of the service/conditions that have been agreed upon;

2. The Ordering Bank requests its Bank to contact the Beneficiary's Bank of Residence/Geography, so that it can issue the Guarantee in favor of the Beneficiary;

3. Ordering Bank requests the Guarantor Bank, (Beneficiary's Bank) to issue the Guarantee in favor of the Beneficiary, counter-guaranteed by it;

4. The Beneficiary Bank reviews the details of the transaction, and accordingly issues the guarantee, refers it to the Ordering Bank;

5.The Ordering Bank refers the guarantee to the Ordering Bank;

6., Ordering Bank validates the Draft and refers it to the Beneficiary.

Note: There are cases where the delivery of the Draft is made by the Beneficiary Bank directly to the Ordering Bank.

Note: There are cases in which the delivery of the Draft is made by the Beneficiary Bank directly to the Authorizing Officer.

Support

If you wish to obtain information according to your needs (opening of letter of credit or consultation of letter of credit status) contact us through the institutional line (+244) 226 460 460 or (+244) 923 168 168.

Have questions? We'll clarify!"

Buy a House

Buy a House

Open a current account

Open a current account

Protect my family

Protect my family

Invest

Invest

Ask for a Card

Ask for a Card

Buy a Car

Buy a Car

Save for the future

Save for the future

Login

Login Open an Account

Open an Account