International Transfers

INTERNATIONAL TRANSFERS

Pay quickly using foreign currency funds transfer

Benefits:

Higher security and guaranteed receipt

Extended payment terms to suppliers

Assessment and mitigation of the main Risks inherent to international trade

Allows the anticipation of funds through parallel banking operations, such as discount or allowances on the letter of credit

Transactions based on the rules and uniform usage of the International Chamber of Commerce, as well as, by the laws of Banco Nacional de Angola

Features

Money transfer via SWIFT, securely, quickly and automatically

Money transfers are allowed by Banco Nacional de Angola, provided that the reason for the operation and supporting documents associated with it are presented

In order to make transfers it is necessary to indicate the IBAN for adhering countries, or the beneficiary's account number and, when applicable, the Clearing Codes (if the transfer is made to the USA) or the Sort Code (if the transfer is made to the UK)

Know the terminology often used and associated with making transfers, namely:

Originator of the transfer request;

Originator's Account Number: Current account number to be debited

Processing Date: Will always be the date of debit to the demand account

Orderer: SWIFT BIC of the beneficiary's bank: Code that allows the identification of Banks in the SWIFT network

Example: 8-position SWIFT BIC:

Start = Code that Identifies the Financial Institution (4 positions)

Middle = Code that Identifies the Country (2 positions)

End = Code that allows geographical distinction within a country (2 positions)

Note: A SWIFT BIC may have up to 11 positions by adding 3 alphanumeric positions at the end, which correspond to the Branch Code

SHA: Shared charges, as a general rule, at the payer's expense are the charges at the origin and at the payee's expense are the charges at the destination

BEN: Charges at the payee's expense

OUR: Charges at the payer's expense

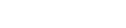

How it works

The Bank of your foreign Supplier forwards to ATLANTICO the documents necessary for pickup the goods imported by your Company. The documents will be delivered to you against payment, acceptance, or partial payment and acceptance of the remainder, according to the conditions determined by the Exporter.

Caption

1. Beneficiary - Requests from the Issuing Party a Bank Guarantee according to the service/conditions that have been agreed upon;

2. The Issuing Party requests its Bank to contact the Beneficiary's Bank of the Residence/Geography, so that it can issue the Guarantee in favor of the Beneficiary;

3. The Issuing Party requests the Guarantor Bank, (Beneficiary's Bank) to issue the Guarantee in favor of the Beneficiary, counter-guaranteed by it;

4. The Beneficiary Bank reviews the details of the transaction, and accordingly issues the guarantee and forwards it to the Issuing Bank;

5. The Issuing Bank forwards the guarantee to the Issuing Party;

6. The Issuing Party validates the documents and forwards them to the Beneficiary.

Note: There are cases where the documents are delivered by the Beneficiary Bank directly to the Issuing Party.

Note: There are cases where the documents are delivered by the Beneficiary Bank directly to the Issuing Party.

Support

If you wish to obtain information according to your needs (opening of letter of credit or verify the letter of credit status) contact us: (+244) 226 460 460 or (+244) 923 168 168.

Have doubts? We'll answer them!

Buy a House

Buy a House

Open a current account

Open a current account

Protect my family

Protect my family

Invest

Invest

Ask for a Card

Ask for a Card

Buy a Car

Buy a Car

Save for the future

Save for the future

Login

Login Open an Account

Open an Account