Documetary Collections

DOCUMENTARY COLLECTIONS

Act in international markets with confidence

Documentary collections require the intervention of the Bank as an agent acting according to instructions received. These instructions involve the delivery of financial documents or commercial documents that convey ownership of the goods to the final beneficiary

Benefits:

Documentary Credit alternative product

Less costs than the costs inherent in opening and maintaining the Documentary Credit

Minimizes the risk of non-performance of obligations contractually assumed by the exporter

Bank financing via discount/advance

Commercial financing of the exporter, if the collection payment is on credit

Parties involved

-

Borrower - Exporter of the goods/Seller/Backer.

-

Borrowing Bank - Exporter's bank that sends the documents to the Importer's bank.

-

Drawee - Importer of the goods/Buyer/Debtor.

-

Drawee's Bank - Importer's bank, responsible for fulfilling collection instructions with the Importer.

ATLANTICO can present itself as the Drawee's Bank, when its Customer is an Importer or the Borrowing Bank when its Customer is an Exporter.

Difference between Import vs Export Documentary Shipments.

Documentary collections - Import (RDIM)

It is a document delivery service, ATLANTICO receives from the Foreign Bank (Borrowing) documents necessary for pickup the goods imported by its Customer, as the importer.

The delivery of these documents to the ATLANTICO Customer can only be done in accordance with the instructions received from the other Bank:

-

An acceptance of a letter;

-

Acceptance and endorsement of a bill or partial payment and acceptance of the remainder;

-

An undertaking in writing to pay at a certain future date;

Documentary collections - Export (RDEX)

ATLANTICO, at the request of its Exporting Customer, sends to the foreign bank the documents for collection, which should be delivered to the importer according to what is stipulated in the Exporting Customer's instructions, which can be:

-

Contrary to payment;

-

Contrary to acceptance of a bill;

-

According to a written commitment to pay at a certain future date;

Collection Types

-

Documents Against Payment;

-

Documents Against Acceptance;

-

Documents Against Written Undertaking to Pay;

-

Documents Against Acceptance and Bank Guarantee;

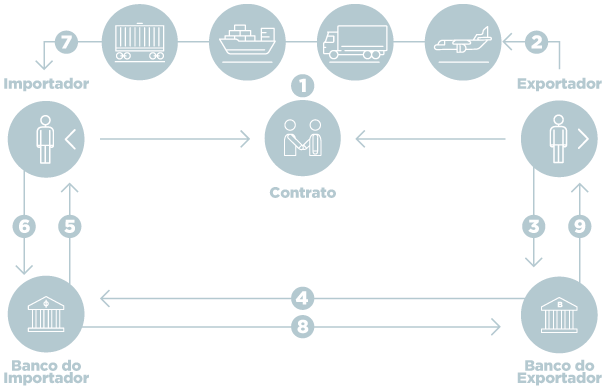

How it works

The Bank of your foreign Supplier forwards to ATLANTICO the documents necessary for pickup the goods imported by your Company. The documents will be delivered to you against payment, acceptance, or partial payment and acceptance of the remainder, according to the conditions determined by the Exporter.

Caption

1. Beneficiary - Requests from the Issuing Party a Bank Guarantee according to the service/conditions that have been agreed upon;

2. The Issuing Party requests its Bank to contact the Beneficiary's Bank of the Residence/Geography, so that it can issue the Guarantee in favor of the Beneficiary;

3. The Issuing Party requests the Guarantor Bank, (Beneficiary's Bank) to issue the Guarantee in favor of the Beneficiary, counter-guaranteed by it;

4. The Beneficiary Bank reviews the details of the transaction, and accordingly issues the guarantee and forwards it to the Issuing Bank;

5. The Issuing Bank forwards the guarantee to the Issuing Party;

6. The Issuing Party validates the documents and forwards them to the Beneficiary;

Note: There are cases where the documents are delivered by the Beneficiary Bank directly to the Issuing Party.

Support

If you wish to obtain information according to your needs (opening of letter of credit or verify the letter of credit status) contact us: (+244) 226 460 460 or (+244) 923 168 168

Have doubts? We'll answer them!

Buy a House

Buy a House

Open a current account

Open a current account

Protect my family

Protect my family

Invest

Invest

Ask for a Card

Ask for a Card

Buy a Car

Buy a Car

Save for the future

Save for the future

Login

Login Open an Account

Open an Account